Best car insurance company in 2024

Outline of the Article

I. Introduction

A. Concise Summary of car Insurance

B. Selecting the best car insurance company Is Crucial

II. Considerations for Factors

A. Coverage Options

B. Premium Rates

C. Customer Service

D. Claim Process

E. Sales and Promotion

III. Best Car Insurance Company in 2024

A. Geico

B. Progressive

C. State Farm

D. Allstate

IV. Comprehensive Accounts

A. Qualities and Advantages of GEICO

B. PROGRESSIVE: Benefits and Drawbacks of Choosing

C. State Farm’s Key Selling Features

D. Reviews from Allstate Consumers

V. Car Insurance Trends and Technologies

A. Advancements in Technology

B. Personalized Policies

C. Green Initiatives

VI. How to Negotiate the Best Car Insurance Rate

A. Comparison Shopping

B. Understanding Policy Terms

C. Using Sales and Discounts

VII. Usual Errors to Keep Away from

A. Overlooking Fine Print

B. Ignoring Customer Reviews

C. Picking the Affordable Choice

VIII. Future Predictions in Car Insurance

A. Emerging Technologies

B. Improvements to the Legal System

C. Consumer Preferences

IX. Conclusion

A. Recap of Key Points

B. Importance of Informed Decision-Making

X. FAQs

A. How frequently should I check the terms of my car insurance policy?

B. Are online quotes accurate?

C. Which elements increase the price of my car insurance?

D. Can I change my car insurance company mid-policy?

E. What is the simplest and most successful way for me to report an issue?

Leading Car Insurance Company of 2024: Taking the Road to Stability

Introduction

Obtaining the right coverage in the complex world of car insurance can be hard. This article covers the world of the best car insurance company in 2024 and provides a thorough analysis of each, attempting to make sense of the important factors driving your decision.

Considerations for Factors

Coverage Options

One of the most crucial things to think about is the range of coverage alternatives that a car insurance provider provides. It is important to determine your requirements, be they basic liability coverage or complete insurance.

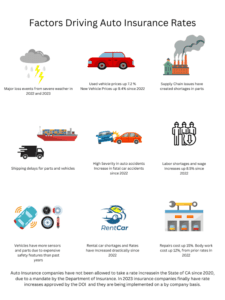

Premium Rates

Even while price is important, it’s critical to find a balance between budget and sufficient coverage. We’ll look at how various businesses set their premium prices and what influences these expenses.

Customer Service

A trusted and friendly customer support team can make all the difference when things become tough. We’ll go into detail about the value of excellent customer service in the context of best car insurance company.

Claim Process

An insurance company’s devotion to its clients can be seen by a simplified and smooth claims method. We’ll demystify the claim procedures of top best car insurance company to guide you through potential scenarios.

Discounts and Offers

Getting auto insurance doesn’t have to be expensive. In order to help you optimize savings without losing coverage, we’ll investigate the numerous discounts and special deals made available by top best car insurance company

Best Car Insurance Company in 2024

Qualities and Advantages of GEICO

In this section, we’ll spotlight GIECO, highlighting its standout features and reasons it claims a spot among the best car insurance company in 2024.

PROGRESSIVE: Pros and Cons Unveiled

No insurer is flawless. To give you an honest evaluation of whether Progressive suits your needs, we’ll weigh its benefits and drawbacks

State Farm’s Key Selling Features

State Farm distinguishes itself through unique offerings. We’ll explore its unique selling points and the reasons it could be the best option for you.

ALLSTATE: The Voice of the Customers

Real user testimonials provide invaluable insights. We’ll share experiences from customers of Allstate, offering a glimpse into the service quality and satisfaction levels.

Comprehensive Accounts

Qualities and Advantages of GEICO

In this article, we’ll examine the characteristics and advantages that will set GEICO apart best car insurance company in 2024, from state-of-the-art technology to unique benefits.

PROGRESSIVE: Pros and Cons Unveiled

clear assessment of Progressive’s advantages and disadvantages that will assist you in selecting a course of action that fits your priorities.

State Farm’s Key Selling Features

Understand the unique features that position State Farm as an opponent for the title of top best car insurance company in 2024.

Reviews from Allstate Consumers

Real stories from customers of Allstate, sharing their experiences and helping you gauge the insurer’s credibility.

Car Insurance Trends and Technologies

Advancements in Technology

The future of car insurance is intertwined with technology. We’ll explore the latest advancements and how they impact your coverage.

Personalized Policies

Tailored insurance policies are gaining prominence. We’ll discuss how insurers are adapting to individual needs, providing flexibility in coverage.

Green Initiatives

Environmental consciousness extends to the insurance sector. We’ll explore the ways that best car insurance company are implementing environmentally friendly practices.

How to Negotiate the Best Car Insurance Rate

Comparison Shopping

It is crucial to compare prices and make sure you are getting the greatest negotiate possible. We’ll provide practical tips for comparing quotes effectively.

Understanding Policy Terms

Insurance terms might be difficult. We’ll simplify the technical language so you can decide on your policy with confidence.

Using Sales and Discounts

Who doesn’t enjoy a good deal? We’ll outline methods for getting the most savings on your best car insurance company without losing coverage.

Usual Errors to Keep Away from

Overlooking Fine Print

Many people forget to read the fine print in their rush to get coverage. We’ll discuss typical problems and how to stay free of them.

Ignoring Customer Reviews

Peer reviews offer valuable insights. We’ll discuss the importance of considering customer feedback in your decision-making process.

Picking the Affordable Choice

Price is a consideration. This is but it’s not always the greatest decision. The dangers of placing affordability before coverage will be discussed.

Future Predictions in Car Insurance

Emerging Technologies

The future holds exciting technological innovations. We’ll discuss how emerging technologies will shape the car insurance landscape.

Changes in Regulatory Landscape

Regulations play a crucial role. We’ll examine anticipated changes and their potential impact on the industry and consumers.

Consumer Preferences

Understanding evolving consumer preferences is key. We’ll explore how companies are adapting to meet the changing needs of customers.

Conclusion

Finally, there are other factors to consider while selecting the best car insurance company, including pricing, reputation, customer service, and policy selections that are easily available. People should think about their personal needs and preferences before selecting best car insurance company. To make an informed decision, compare quotes, research client referrals, and look into the company’s financial soundness. Finally, the ideal insurance provider for each individual is determined by their unique needs and interests. To locate a trustworthy and appropriate insurance partner, do extensive research and keep up with the always changing insurance industry.

FAQs

How frequently should I check the terms of my car insurance policy?

Regularly reviewing your policy is advisable, especially when major life events occur, such as buying a new car or moving to a new location.

Are online quotes accurate?

Online quotes provide a good estimate, but factors like driving history and additional coverage may affect the final premium.

Which elements increase the price of my car insurance?

Factors include your driving record, age, location, and the type of coverage you choose.

Can I change my car insurance companies mid-policy?

Yes, you can switch, but be aware of any potential fees or discounts you may lose in the process.

What is the simplest and most successful way for me to report an issue?

Most insurers offer online and phone claim reporting. Follow the outlined steps in your policy documents for a swift process.