The best loan company for students in 2024

Outline of the Article

1. Introduction

A. Brief overview of the importance of best loan company for students

B. The role of the best loan company for students in 2024

2. Why Students Need Loans

A. Rising tuition fees

B. Cost of living expenses

C. Other financial challenges faced by students

3. Key Criteria for Choosing the best loan company for students

A. Interest rates

B. Repayment options

C. Customer service and support

4. LendWise: A Friendly Choice

A. Introduction to LendWise

B. special features that make it suitable for students

C. Testimonials and success stories

5. Loan Application Process with LendWise

A. Easy application steps

B. Approval and disbursement timeline

C. Required documentation

6. Comparative Analysis with Other Loan Companies

A. Contrasting LendWise with other popular loan companies

B. Highlighting unique advantages

7. Flexible Repayment Options

A. Overview of LendWise’s repayment plans

B. How flexibility benefits students

8. Tips for Responsible Borrowing

A. Budgeting advice

B. Understanding loan terms

C. The Importance of financial literacy for students

9. Addressing Concerns: Common Misconceptions

A. Debunking myths about student loans

B. Clarifying doubts related to LendWise

10. Success Stories of Students with LendWise Loans

A. Real-life examples of students who benefited from LendWise

B. How LendWise contributes to academic success

11. Customer Support and Assistance

A. Availability of support channels

B. Responsive customer service for students

12. Future Prospects: LendWise’s Vision for 2024

Upcoming features and improvements

Commitment to student welfare

13. Expert Opinions and Reviews

A. Insights from financial experts

B. Reviews from reputable sources on LendWise

14. Conclusion

A. Recap of why LendWise stands out

B. encouragement for students to make informed decisions

15. FAQs

A. Frequently asked questions about student loans and LendWise

Best Loan Company for Students in 2024: LendWise

Student life comes with its own set of challenges, and one significant hurdle is managing finances. With tuition fees on the rise and the ever-increasing cost of living, many students find themselves in need of financial support. In this quest for assistance, the choice of a reliable loan company becomes crucial. As of 2024, one standout option is LendWise

Why Students Need Loans

Rising Tuition Fees

- The constant surge in tuition fees has made it difficult for students to pursue higher education without financial aid. LendWise recognizes this challenge and offers competitive rates to make education accessible. They can use the best loan company for students.

Cost of Living Expenses

- Beyond tuition, students face the daily expenses of living away from home. LendWise takes these necessities into account, providing the best loan company for students that covers not only academic costs but also accommodation, food, and for more detail visit here.

Other Financial Challenges

- From unexpected medical expenses to urgent travel requirements, students often encounter unforeseen financial challenges. LendWise’s flexible best loan company for students options cater to such needs, ensuring students can focus on their studies without undue financial stress.

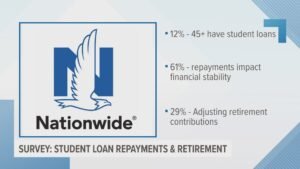

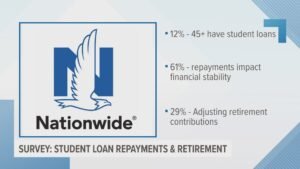

Key Criteria for Choosing a Loan Company

- When selecting a best loan company for students, students should consider various factors. Interest rates, repayment options, and the quality of customer service are paramount.

LendWise: A Friendly Choice

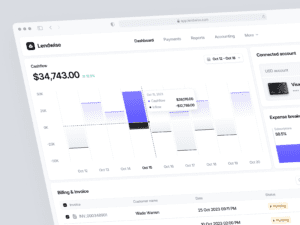

Introduction to LendWise

- LendWise stands out for its student-friendly approach. The company understands the unique financial situations students face and tailors its services accordingly.

Special Features

- LendWise offers features like low interest rates, customizable repayment plans, and a user-friendly online platform. These aspects make it an ideal choice for students seeking financial assistance.

Testimonials and Success Stories

- Real-life success stories from students who have benefited from LendWise loans underscore the positive impact the company has on individuals’ academic journeys.

Loan Application Process with LendWise

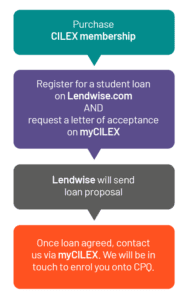

- Applying for a loan with LendWise is a straightforward process, ensuring minimal hassle for students.

Easy Application Steps

- LendWise simplifies the application process, allowing students to apply online with ease. The user-friendly interface ensures that even those unfamiliar with financial procedures can navigate the process effortlessly.

Approval and Disbursement Timeline

- One of the key advantages of choosing LendWise is its quick approval and disbursement timeline. Students can expect timely access to the funds they need.

Required Documentation

- To streamline the application process, LendWise requests only essential documentation, eliminating unnecessary paperwork for students.

Comparative Analysis with Other Loan Companies

- In a sea of loan options, LendWise distinguishes itself through a comparative analysis with other leading best loan company for students

Contrasting LendWise

- LendWise’s competitive interest rates and unique features set it apart from other companies. A detailed comparison demonstrates why it’s a top choice for students.

Highlighting Unique Advantages

- From lower interest rates to flexible repayment plans, LendWise’s advantages are accentuated in comparison to other loan providers.

Flexible Repayment Options

- LendWise understands the financial uncertainty students may face after graduation and offers flexible repayment plans.

Overview of LendWise’s Repayment Plans

- LendWise provides various repayment options, allowing students to choose the best loan company for students that aligns with their financial capabilities.

How Flexibility Benefits Students

- Flexibility in repayment ensures that students can comfortably repay their loans, fostering financial responsibility without compromising their academic pursuits.

Tips for Responsible Borrowing

Budgeting Advice

- To empower students with financial literacy, LendWise offers budgeting advice, helping them manage their funds efficiently.

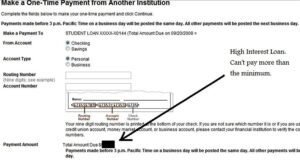

Understanding Loan Terms

LendWise prioritizes transparency, ensuring that students fully comprehend the terms of their best loan company for students to make informed decisions.

Importance of Financial Literacy

LendWise recognizes the significance of financial literacy for students and aims to enhance awareness through educational initiatives.

Addressing Concerns: Common Misconceptions

Debunking Myths About best loan company for students

- LendWise addresses common myths about student loans, providing clarity on aspects often misunderstood by borrowers.

Clarifying Doubts

- LendWise’s commitment to transparency extends to addressing doubts and concerns, fostering trust between the company and its borrowers.

Success Stories of Students with LendWise Loans

Real-Life Examples

- Actual students share their success stories, illustrating how LendWise has played a pivotal role in their academic achievements.

Contributing to Academic Success

LendWise’s impact on students goes beyond financial support, contributing positively to their overall academic success.

Customer Support and Assistance

Availability of Support Channels

- LendWise ensures that students have access to reliable customer support channels, creating a sense of security throughout their loan journey.

Responsive Customer Service

- The responsiveness of LendWise’s customer service team adds another layer of assurance for students, knowing help is just a call or click away.

Future Prospects:

LendWise’s Vision for 2024

- LendWise looks ahead to the future with plans for improvements and new features to further enhance the student borrowing experience.

Upcoming Features and Improvements

- A glimpse into the roadmap reveals LendWise’s commitment to continuous improvement, ensuring it remains a top choice for students in 2024.

Commitment to Student Welfare

- LendWise emphasizes its dedication to the welfare of students, aligning its goals with the aspirations of those seeking higher education.

Expert Opinions and Reviews

Insights from Financial Experts

Financial experts weigh in on why LendWise stands out, providing valuable perspectives on its suitability for student borrowers.

Reviews from Reputable Sources

Reputable sources in the financial industry offer unbiased reviews, further solidifying LendWise’s reputation as a trustworthy loan provider.

Conclusion of best loan company for students

- In conclusion, LendWise emerges as the best loan company for students in 2024. Its student-friendly approach, competitive rates, and commitment to transparency make it a reliable choice for those navigating the financial challenges of higher education.

FAQs

1. What makes LendWise the best choice for student loans in 2024?

- LendWise stands out due to its competitive rates, flexible repayment options, and a commitment to student welfare.

2. How quickly can I expect loan approval and disbursement with LendWise?

- LendWise prides itself on a quick approval and disbursement timeline, ensuring timely access to funds.

3. Are there any hidden fees associated with LendWise loans?

- LendWise prioritizes transparency, and there are no hidden fees. All costs are clearly communicated to borrowers.

4. Can I customize my repayment plan with LendWise?

- Yes, LendWise offers various repayment plans, allowing students to choose the one that best suits their financial situation.

5. What sets LendWise apart from other loan companies for students?

- LendWise distinguishes itself through competitive interest rates, unique features, and a focus on student success.