Best Otto Insurance Review 2024: Exploring Comprehensive Coverage with a Friendly Touch

Outline of the Article

I. Introduction

A. An Overview of Otto Insurance Review

B. Importance of Otto Insurance review in 2024

II. The Evolution of Otto Insurance

A. Founding Principles

B. Significant Results

C. 2024’s Flexible Strategies

III. Unpacking Otto Insurance Policies

A. Auto Insurance

1. Coverage Options

2. Premium Structures

B. Home Insurance

1. Complete Safety

2. Policy Customization

IV. Customer Service and Client Satisfaction

A. Online Platform

1. Simple-to-operate Interface

2. Accessibility Features

B. Client Testimonials

1. Actual Situations

2. Highlights of Positive Feedback

V. Technological Advancements in Otto insurance review

A. Integration of AI

B. Mobile App Enhancements

C. Digital Claim Processing

VI. Otto Insurance in the Community

A. Ideas for social responsibility in business

B. Community Engagement Programs

VII. Qualified Views and Reviews

A. Industry Analyst Opinions

B. Competitor Comparisons

VIII. Otto Insurance in the News

A. Recent Media Coverage

B. Noteworthy Events

IX. upcoming hopes

A. Anticipated Innovations

B. Projected Growth

X. Conclusion

A. Summarizing Otto Insurance’s Strengths

B. Promoting Careful Insurance Policies

Otto Insurance Review 2024: Navigating the Landscape of Trust and Security

Since it was founded, Otto insurance review has been an institution in the insurance sector, always changing to meet the ever-changing demands of its clients. This essay seeks to offer a thorough analysis of Otto insurance review as we move into 2024 by exploring its user experience, policy, technological developments, engagement with the community, and future possibilities.

I. Introduction

A. An Overview of Otto Insurance Review

Otto Insurance stands out as a dependable player in the difficult insurance market by providing a variety of coverage alternatives to protect people and their valuables.

B. Importance of Otto Insurance review in 2024

Otto Insurance Review set off on its path with a dedication to honesty, openness, and customer satisfaction. The company’s operations are still guided by these basic ideals, which promote customer trust.

II. The Evolution of Otto Insurance

A. Founding Principles

Otto Insurance’s journey began with a commitment to integrity, transparency, and client satisfaction. These founding principles continue to guide the company’s operations, fostering trust among policyholders.

B. Significant Results

With time, Otto insurance review has won awards for its outstanding service, developed a solid reputation as a reliable insurance company, and achieved respect.

C. 2024’s Flexible Strategies

Otto Insurance Review has put methods of adaptation into place in response to the changing needs of its customers, making it relevant and flexible in a changing market.

III. Unpacking Otto insurance review Policies

A. Auto Insurance

1. Coverage Options

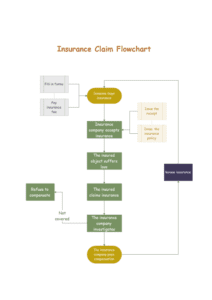

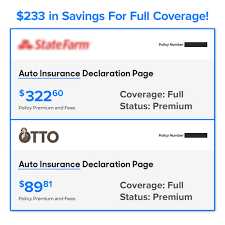

Otto Insurance offers a variety of coverage options that are customized to meet the needs of each individual, going beyond the traditional. Plans that include basic liability to comprehensive coverage are available for all vehicles.

2. Premium Structures

Understanding the financial constraints of its clients, Otto insurance review provides flexible premium structures, making quality coverage accessible to a diverse clientele.

B. Home Insurance

1. Complete Safety

Otto’s house insurance plans go beyond basic protection, offering complete defense against unplanned events like theft and natural disasters.

2. Policy Customization

Otto insurance review recognizes that every home is different, therefore it gives customers the option to personalize their plans to make sure they exactly meet their needs.

IV. Customer Service and Client Satisfaction

A. Online Platform

1. Simple-to-operate Interface

With an easy-to-use online platform, Otto insurance review puts the needs of its customers first, making it easier to get figures, manage policies, and submit claims.

2. Accessibility Features

Otto Insurance places a high value on inclusion, including accessible features into their digital platforms to provide an enjoyable experience for all.

B. Client Testimonials

1. Actual Situations

Customers share their experiences through first-hand experiences, highlighting situations where Otto insurance review went above and beyond to assure potential clients.

2. Highlights of Positive Feedback

Positive reviews continuously highlight Otto Insurance’s dedication to providing timely and dependable service, strengthening its standing as an insurer that prioritizes its clients.

V. Technological Advancements in Otto insurance

A. Integration of AI

Otto Insurance stays at the forefront of innovation by integrating artificial intelligence into its processes, streamlining operations, and enhancing decision-making.

B. Mobile App Enhancements

Recognizing the mobile-centric nature of contemporary living, Otto Insurance continually enhances its mobile app, providing convenience at policyholders’ fingertips.

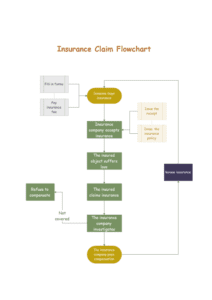

C. Digital Claim Processing

Efficient digital claim processing sets Otto Insurance Review apart, ensuring quick and hassle-free settlements for its clients.

VI. Otto Insurance in the Community

A. Ideas for social responsibility in business

Otto Insurance strongly participates in corporate social responsibility, going above and beyond the call of duty to support the preservation of the environment, disaster aid, and community development.

B. Community Engagement Programs

By actively taking part in community events, Otto insurance reviews create relationships that go beyond the context of insurance transactions and promote a sense of community.

VII. Qualified Views and Reviews

A. Industry Analyst Opinions

Insurance experts admire Otto Insurance Review for its unique strategy, sound financial standing, and strategic mindset.

B. Competitor Comparisons

A comparative analysis with competitors showcases Otto Insurance’s unique value propositions, positioning it as a top choice among discerning consumers.

VIII. Otto Insurance in the News

A. Recent Media Coverage

Otto Insurance’s recent media coverage highlights key milestones, partnerships, and contributions, keeping the public informed about its impactful initiatives.

B. Noteworthy Events

Otto Insurance is further established as a thought leader and important player in the insurance market through participation in industry events and significant conferences.

IX. Upcoming hopes

A. Anticipated Innovations

Otto Insurance’s focus on innovation paves the way for much more advanced and user-friendly products, setting the stage for expected developments.

B. Projected Growth

Analyzing market trends and strategic moves, Otto Insurance’s projected growth indicates a promising future, reinforcing its status as an industry leader.

X. Conclusion

A. Summarizing Otto Insurance’s Strengths

To sum up, Otto Insurance Review is unique because of its wide coverage, friendly style, innovative technology, involvement in the community, and long-term planning.

B. Promoting Careful Insurance Policies

It is our responsibility as customers to follow responsible insurance practices. In addition to offering financial protection, Otto Insurance promotes a group effort to protect the areas we love.

FAQs

1. Is Otto Insurance only for auto and home coverage?

No, while auto and home insurance are prominent offerings, Otto Insurance provides a diverse range of coverage options, including health, travel, and business insurance.

2. How does Otto Insurance handle claim processing?

Otto Insurance employs digital claim processing, ensuring swift and efficient settlements for its clients.

3. Do customers with policies for a long time eligible for any discounts?

In order to thank long-term customers for their unwavering trust and dedication, Otto Insurance does, in fact, give loyalty discounts.

4. Can I customize my insurance policy with Otto?

Absolutely. Otto Insurance encourages policy customization, allowing individuals to tailor their coverage according to their specific needs.

5. How does Otto Insurance contribute to the community?

Otto Insurance regularly participates in CSR programs that support the preservation of the environment, disaster aid, and community development.