Otto Insurance BBB: Exploring Transparency and Customer Satisfaction

- In the era of insurance, the understanding of your chosen provider is necessary. One crucial factor in assessing an insurance company’s reliability is its Better Business Bureau (BBB) rating. the specifics of Otto Insurance BBB rating, exploring the intricacies of their offerings, customer feedback, and they respond to industry trends.

What is Otto Insurance BBB?

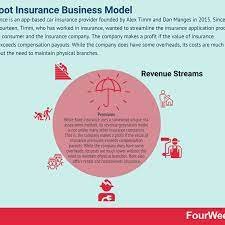

- The business sets itself apart with an effective claims procedure, open lines of communication, and a fusion of digital ease and individualized client care.

- Otto Insurance BBB works to dispel common misconceptions about the insurance industry by offering highly customizable policies, streamlining the claims process, and maintaining a commitment to compassionate and considerate customer care.

- In order to determine the company’s ongoing commitment to quality and innovation in the insurance business as it develops, customer feedback is essential.

BBB Rating Explained

- A company’s overall dependability, moral principles, and customer service are evaluated to determine its Better Business Bureau (BBB) rating. This rating represents Otto Insurance BBB commitment to ethical business practices, transparency, and customer service as determined by the Better Business Bureau.

- Otto Insurance BBB A+ grade indicates that the company has a high level of integrity and dependability, which reassures customers that it continuously maintains moral standards and provides adequate service.

- Customers seeking up-to-date and accurate information regarding Otto Insurance BBB performance and rating should contact the local office or visit the BBB website.

Otto Insurance’s BBB Rating

- Otto Insurance BBB has an excellent BBB rating of A+ as of the most recent information that is available. The Better Business Bureau’s evaluation of Otto Insurance’s dedication to moral business conduct, openness, and customer service is reflected in this rating.

- Otto Insurance BBB A+ rating demonstrates a high degree of integrity and reliability, reassuring clients that the company consistently upholds ethical standards and offers satisfactory service.

- Customers should visit the BBB website or get in touch with the local office to obtain the most current and accurate information about Otto Insurance BBB performance and rating.

User Reviews and Problems

- An essential part of assessing Otto Insurance BBB performance and client satisfaction are customer evaluations and complaints. Positive evaluations frequently draw attention to the business’s advantages, which include adaptable policies, effective claims procedures, and attentive customer support.

- Complaints offer important insights into areas that might need addressed, like difficulties with communication or perceived deficiencies in service. Prospective clients are given a comprehensive picture of Otto Insurance BBB overall performance as well as its dedication to resolving and enhancing particular issues based on both positive and negative feedback.

- This all-encompassing strategy guarantees a better educated decision-making process for people looking for dependable and client-focused insurance products.

Transparency in Policies

- One of the main tenets of Otto Insurance BBB dedication to offering a reliable and customer-focused experience is policy transparency. feel that insurance should have easily comprehensible terms and conditions to give clients a thorough grasp of their coverage.

- To enable clients to make knowledgeable decisions, this openness includes information on coverage limitations, deductibles, and any exclusions.

- Otto Insurance BBB values open communication, and their dedication to transparency guarantees that customers feel secure and informed about the protection they receive while also promoting a culture of trust. the cornerstone of our customer-focused approach to insurance, we always strive to uphold this transparency.

Improvements Over Time

- Over the years, Otto Insurance BBB has continuously shown that it is dedicated to making changes, changing its offerings in response to client input and market developments.

- The organization has improved a number of areas through an iterative process of refinement, including as the ability to customize policies, the speed at which claims are processed, and the general customer experience.

- These enhancements demonstrate Otto Insurance’s commitment to remaining adaptable to its customers’ changing needs. Otto Insurance BBB makes sure that its services are still dependable and in line with the constantly shifting insurance market by continually seeking out client feedback and improving those areas.

- Otto Insurance BBB dedication to ongoing development establishes it as a progressive and innovative supplier of insurance products.

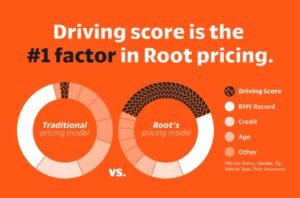

Competitor Comparison

- Otto Insurance stands itself from its rivals in a number of significant ways. Clients can customize coverage to meet their specific needs thanks to our fully customizable plans, which sets us apart in the market.

- Otto Insurance is frequently commended for its effective claims process, which provides prompt and simple responses that improve the client experience.

- The organization offers user-friendly web tools and a customer care team that is responsive, all while striking a balance between digital ease and personalized attention.

Advice on Selecting an Insurance Company

- An insurance company needs to take a calculated strategy. through evaluating certain requirements, be they for life, home, or auto insurance. Investigate and contrast possible suppliers in-depth, taking into account aspects like cost, coverage choices, and client feedback. the company’s financial stability, since this shows that it can fulfill its commitments.

- A smooth claims procedure and high-quality customer support are essential for a satisfying experience. Seek for suppliers who have alternatives for modification so that policies can be customized.

- Find out what discounts are available to maximize coverage while minimizing expenses. Make an informed choice and choose an insurance company that fits specific needs by taking these aspects into account.

Real-life Experiences

- While selecting an insurance company, firsthand experiences frequently offer the most insightful viewpoints. Speak with loved ones, coworkers, or friends who have done business with the company you are thinking about.

- Anecdotes from personal experience can provide insight about a provider’s degree of customer service, simplicity of filing claims, and responsiveness at difficult circumstances. Customer reviews and online forums can also provide a plethora of information.

- These first-hand accounts, both good and bad, offer a sophisticated perspective of how an insurance company acts in real-world scenarios. You can obtain insightful information from these real-life interactions that goes beyond what is advertised, which will assist you in selecting the best insurance partner for your needs.

Otto Insurance’s Response to Feedback

- Otto Insurance has a proactive strategy to handle and learn from consumer feedback, and it is highly valued. Positive comments are valued as confirmation of our dedication to providing top-notch service. When complaints or issues are brought up, a committed customer support team gets in touch with clients right away to fully comprehend their experiences.

- try to address particular problems, offer answers, and, if needed, put improvements into practice based on the knowledge acquired. By continually striving to improve its services and uphold the highest standards of customer satisfaction, Otto Insurance is able to stay responsive to the needs of its clients thanks to this ongoing feedback loop.

- The company’s active listening, responsiveness, and evolution in response to the insightful criticism it receives from its esteemed clients serve as examples of its commitment to accountability and openness.

Future Prospects

- As long as Otto Insurance maintains its dedication to innovation, client delight, and industry leadership, the company’s prospects are bright. Otto Insurance expects to continue improving its services and being at the forefront of the insurance industry by being proactive in responding to consumer input.

- The company’s strategy for the future is sustained growth driven by its commitment to openness, flexible policies, and a flawless client experience. Otto Insurance is prepared to adjust as technology develops and consumer expectations change.

- It will embrace new trends and provide creative solutions to satisfy its customers’ changing needs. Otto Insurance is positioned as a dynamic and forward-thinking leader in the insurance industry’s future because to its continuous focus on improvement.

Industry Trends

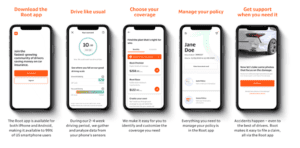

- Insurance providers, such as Otto Insurance, have to keep up with industry advancements to remain relevant and flexible in response to shifting customer needs. Numerous changes are influencing the insurance sector.

- As insurance businesses employ technology to improve customer experiences, procedures, and more personalized services, there is a greater emphasis on digitization.

Conclusion

- The BBB rating of Otto Insurance, in summary, attests to its dedication to transparency and customer satisfaction. Readers can use this information to make well-informed decisions when choosing an insurance provider. Be informed, ask questions, and select insurance that fits your needs and values. Otto Insurance demonstrates its proactive and innovative nature in the insurance market. client happiness, and continuous development, the company skillfully and creatively handles changes in the market. Otto Insurance’s prompt response to customer feedback, emphasis on personalized products, and integration of cutting-edge technologies have put it at the forefront of the rapidly changing insurance sector.

FAQs

1. What is Otto Insurance BBB current rating?

- Based on the most recent data, Otto Insurance has an outstanding A+ BBB rating, demonstrating a high degree of reliability and client satisfaction.

2. How does Otto Insurance respond to customer feedback on the BBB platform?

- Otto Insurance actively engages with customer feedback on the BBB platform, responding promptly to address concerns, provide solutions, and demonstrate a commitment to continuous improvement.

3. Are there common themes in customer reviews on the BBB site for Otto Insurance?

- Examining customer reviews on the BBB site reveals common themes such as positive experiences with customization options, efficient claims processes, and responsive customer service.

4. Has Otto Insurance received any notable awards or recognitions from the BBB?

- Otto Insurance’s A+ rating from the BBB itself is a noteworthy recognition of the company’s adherence to ethical business practices and customer satisfaction, even though specific accolades may vary.

5. How can I check the BBB rating and reviews for Otto Insurance?

- Go to the official Better Business Bureau website (www.bbb.org) and search for Otto Insurance using the provided search bar to confirm Otto Insurance’s current BBB rating and check customer reviews.

1. Visit the Veygo website.

1. Visit the Veygo website.