The Complete Guide to Loans for students with no income in 2024

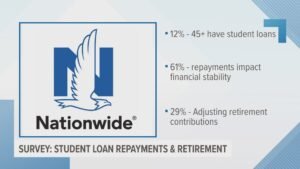

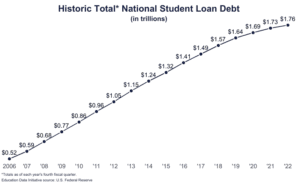

- Embarking on a higher education journey is an exciting chapter in every student’s life, but the financial challenges that accompany it can be daunting. In 2024, with the rising costs of tuition and limited employment opportunities for students, the need for accessible and suitable loans becomes crucial.

Recognizing the Economic Challenges Students Experience

Increasing Costs of Education in loans for students with no income

- The rapidly increasing price of tuition is one of the main challenges students face. When this financial obstacle arises, finding ways to finance education becomes important.

Limited Work Options

- Compared to past generations, the competitive employment market of today can often make it difficult for students to locate part-time work. The dearth of work prospects highlights how important financial assistance is.

The Value of Loans for Students without income

Facilitating Education Access

- With the help of loans for students with no income can now access higher education and realize their goals, even in the face of financial hardship. Understanding their importance is vital for individuals navigating the complex landscape of student loans.

Building Credit History

- In addition, student loans contribute to building credit history, which is an essential factor that determines future financial security. Understanding the use of loans as pressure to increase credit is a smart decision.

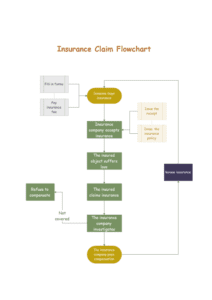

Federal Student Loans: A Viable Option

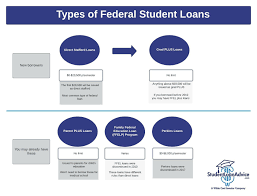

Federal Student Loan Types

- There are several options available for federal loans for students with no income to meet a range of needs. it is important to investigate your options, including subsidized and unsubsidized loans.

Qualifying Requirements

- For students without a source of income, the federal student loan eligibility requirements are crucial. A more simple application procedure can be guaranteed by understanding the requirements.

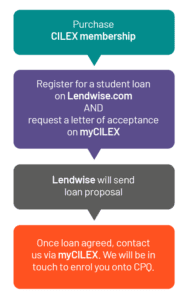

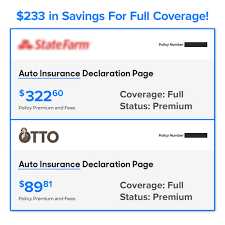

Considering Private Student Loan Options

Private Student Loans: Benefits and Drawbacks

- Private loans for students with no income offer an alternative to government loans, which are a popular option. the benefits and drawbacks enable students to make an informed decision that supports their financial goals.

Selecting the Best Private Loan

- Selecting the right loans for students with no income requires thorough research. students on factors to consider when making this crucial decision.

Scholarships and Grants: Tapping into Financial Aid

Identifying Eligibility

- Beyond loans, scholarships and grants provide valuable financial aid. Understanding the eligibility criteria increases the chances of securing this assistance.

Application Tips

- Effective scholarship and grant applications require a strategic approach. Tips on crafting compelling applications are essential for success.

Budgeting Tips for Students

Creating a Realistic Budget

- Budgeting is an important skill for loans for students with no income. practical tips for creating and adhering to a realistic budget.

Reducing Unnecessary Expenses

- One of the most essential elements of financial management is recognizing and getting rid of unneeded costs.

Practical advice on reducing costs helps students stretch their budget.

Part-Time Work Opportunities for Students

Balancing Work and Studies

- Finding the right balance between work and study is essential. This section explores part-time work opportunities that allow students to manage both effectively.

Leveraging Campus Employment

- Many campuses offer employment opportunities for students. leveraging these resources can control financial instability.

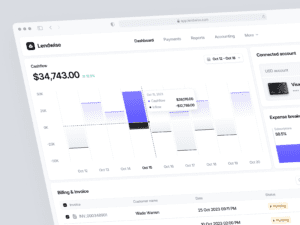

Building a Financial Safety Net

Emergency Funds

- Establishing an emergency fund offers protection against unexpected expenses. This section guides students on building and maintaining this essential financial cushion.

Smart Saving Strategies

- Incorporating smart saving strategies into daily life helps students accumulate funds for future needs. Practical advice on saving ensures financial resilience.

Credit Building for Future Financial Success

Importance of Good Credit

- Understanding the importance of good credit opens doors to future financial success. The long-term benefits of responsible credit management.

Use of Credit Cards in a Responsible Way

- Integrating a credit card into financial planning requires caution. Students who use credit cards responsibly are guaranteed to make well-informed choices.

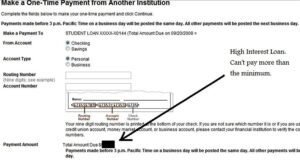

Strategies for Repaying Expenses

Repayment Plans and Holiday times

- Navigating loans for students with no income involves understanding grace periods and selecting suitable repayment plans. The process for students preparing to repay their loans.

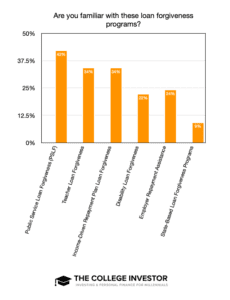

Programs for Forgiving Expenses

- Loan forgiveness programs provide insight into opportunities for reducing or eliminating student loan debt. This valuable information supports long-term financial planning.

Navigating Financial Literacy

Workshops and Resources

Enhancing financial literacy is an ongoing process. Students can access workshops and resources to deepen their understanding of personal finance.

Seeking Professional Advice

- For personalized guidance, seeking advice from financial professionals is advisable. This section outlines the benefits of consulting experts for tailored financial advice.

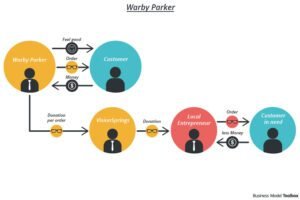

Real-Life Success Stories

Overcoming Financial Struggles

- Real-life success stories inspire and motivate. Narratives of individuals who overcame financial challenges provide encouragement for loans for students with no income facing similar struggles.

Realizing Economic and Educational Targets

- The idea that achieving both financial security and academic success is possible is proven by showcasing the experiences of people who have managed to combine their responsibilities with their studies.

Popular Lies Regarding Student Loans

Eliminating Lies

- It’s crucial to remove common misunderstandings about student loans in order to make wise decisions. eliminates misconceptions and offers information on the actualities surrounding loans for students with no income.

Understanding Loan Realities

- Understanding the true nature of loans for students with no income ensures students approach borrowing with realistic expectations. This section sheds light on the nuances of loan processes.

Conclusion

- In conclusion, navigating the landscape of loans for students with no income requires a multifaceted approach. From federal options to private alternatives, scholarships, and budgeting tips, aims to equip students with the knowledge needed for informed financial decisions.

FAQs

1. Can I apply for a student loan if I’m jobless?

- Yes, students without income can apply for federal student loans; however, their eligibility is based on criteria other than their income.

2. Are student loans from private companies risky?

- There are benefits and drawbacks to private student loans. Problems are reduced by reading the agreements carefully and selecting a reliable supplier.

3. How can a student without a source of income obtain credit?

- Students may build credit by using credit cards responsibly and making their loan payments on time.

4. Which falsehoods about debt from college are most common?

- Some frequent misunderstandings include concerns about credit score effects, fast repayment, and restricted possibilities.

5. Where are the workshops on money management available?

- Many universities offer workshops, and online resources provide comprehensive financial education for students.