Is bright money legit in 2024? By providing the latest technology that can help people successfully manage their finances, Bright Money will still be able to uphold its credibility as a financial management platform in 2024. Bright Money offers customized insights and suggestions to enhance spending, saving, and investing practices, with a focus on utilizing technology and data analytics. Positive user reviews have been received by the platform, showing its efficacy in assisting people in reaching their financial objectives and its proactive approach to financial wellness.

Is bright money legit in 2024? Reviews and feedback

Before using any financial platform, Is bright money legit in 2024, people should be very cautious and make sure they have done their homework. Even though the platform might provide insightful information and useful tools, it’s important to evaluate its privacy policies, security measures, and terms of service to guarantee the protection and privacy of sensitive financial data. looking for feedback from consumers might offer insightful information about the reliability and efficiency of the platform. although Bright Money might offer encouraging prospects for managing finances, people need to approach it cautiously and mindful of the risks involved.

Bright Money Overview

The goal of the financial management platform Bright Money is to completely transform how people handle their money. Bright Money provides consumers with a complete solution to optimize their investment, saving, and spending habits through a combination of modern technology and customized insights.

- Bright Money’s proactive approach to financial wellness also includes features that help customers save money and stay on track toward financial success, like bill bargaining and subscription management.

- All things considered, Bright Money is more than simply a budgeting tool; it’s a complete financial partner that enables users to realize their financial goals and create a better financial future.

- Bright Money is positioned to transform personal finance management and enable people to reach their maximum financial potential with its advanced technology and customized approach.

What is Bright Money?

A platform for managing funds called Bright Money was created to help people take charge of their money and reach their financial objectives.

- It analyzes users’ financial data using advanced technology and algorithms to provide recommendations and insights that are unique to each user.

- Is bright money legit in 2024 gives customers the power to manage their finances and make wise decisions by providing tools for budgeting, tracking spending, and setting savings goals.

- The platform also provides proactive options to help users save money and strengthen their financial position, such as bill negotiation and subscription management.

- Bright Money is a complete financial partner that points consumers in the direction of a better financial future.

Is Bright Money safe and legit?

Bright Money continues to maintain its standing as a trustworthy and safe financial management platform as of 2024. The organization places a high priority on the security and privacy of the financial data of its users, putting strong encryption protocols and strict security measures in place to protect critical information. Bright Money follows customs and rules, maintaining legal compliance and being open about its business methods.

- users have given Bright Money favorable evaluations and feedback, showing its effectiveness in helping people manage their finances and achieve their financial objectives.

- The website has gained confidence and trust among its user base thanks to its proactive approach to financial wellness, user-friendly layout, and personalized advice.

- As with any financial platform, users must, nevertheless, proceed with caution and due investigation. Even though Is bright money legit in 2024 largely accepted as trustworthy and reputable, users should make sure they are comfortable giving the platform access to their financial information by reading through its terms of service, privacy policies, and security measures.

Maintaining the security of personal and financial data also requires being on the lookout for potential frauds and phishing efforts. Bright Money seems to be a respectable and reliable choice for anybody looking to efficiently manage their cash.

Bright Money Savings

The Bright Money financial management platform includes a function called Bright Money Savings that is designed to help users optimize their saving practices and reach their financial objectives. This tool analyzes users’ purchasing habits and finds areas where savings can be made using advanced algorithms and personalized insights. Bright Money Savings enables consumers to establish a consistent savings plan and make proactive recommendations using automated processes.

- Users of Bright Money Savings can establish targeted savings objectives for long-term investments, emergencies, or trips.

- The platform gives users the ability to monitor their progress toward these objectives, which promotes accountability and transparency.

- Bright Money Savings might provide features like round-up choices and automatic transfers, which make it simple for consumers to consistently add money to their savings accounts.

Bright Money Savings is a useful instrument for people who want to improve their financial situation and safeguard their future. Bright Money Savings assists consumers in creating sound saving practices and confidently achieving their financial goals by utilizing technology along with customized advice.

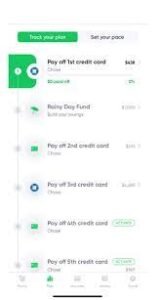

Paying Off Credit Card Debt with Bright Money

For those who want to improve their financial situation and pay off credit card debt, Bright Money provides a complete option. Bright Money gives people the instruments and direction they need to approach credit card debt strategically and successfully through its user-friendly platform and customized information.

- One of Bright Money’s primary features is its debt payback planner, which evaluates users’ financial information and generates a personalized strategy for effectively paying off credit card debt.

- Based on variables including interest rates and balances, the website helps users rank their debts, enabling them to prioritize paying off high-interest debt first while making the minimum payments on other accounts.

- Bright Money helps customers find areas where they may cut back on spending and put more money toward paying off debt by providing budgeting tools and expense tracking capabilities.

- The platform offers realistic advice and methods for speeding debt repayment, such as arguing for reduced interest rates or combining debt into a single loan with a cheaper interest rate.

Through the use of modern technology and individualized coaching, Is bright money legit in 2024 users can take charge of their credit card debt and aim toward financial freedom. People may make significant progress toward reaching their financial objectives and guaranteeing a better financial future by putting a clear plan in place and using Bright Money’s tools and resources.

Increasing Credit Score with Bright Money

In order to help consumers strengthen their financial profile and raise their credit score, Bright Money provides useful tools and information. Bright Money provides its consumers with individualized insights and an innovative platform that enable them to take proactive measures to improve their credit standing and reach their financial objectives.

- Bright Money offers users a full view of their credit record and score through its credit monitoring and analysis tools, which are among its primary features.

- Users can keep track of any changes or inconsistencies in their credit information and take appropriate steps to resolve any concerns that might be damaging their credit score by regularly tracking it.

- In order to assist consumers in creating and preserving a good credit history, Bright Money provides specific guidance and techniques.

- This could contain pointers on how to use credit cards responsibly, such as paying on time and maintaining a small balance compared to your credit limit.

- Insights into additional variables that may impact credit ratings, such as account types and credit history duration, are also provided by Bright Money.

Through the use of Bright Money’s advice and insights, customers may create sound financial practices and make educated decisions that can eventually raise their credit score. People may take charge of their financial future and work toward reaching their long-term financial objectives if they have access to useful tools and services.

Build Savings with Bright Money

Bright Money offers a strong platform that enables customers to successfully grow their money and reach their financial objectives. For those wishing to start and gradually increase their savings, Bright Money provides a comprehensive solution with its user-friendly interface and customized insights.

- Bright Money’s automated savings capabilities, which make it simple for users to set aside money on a regular basis, are among its best features.

- Bright Money makes it easy for users to add money to their savings accounts by offering features like automatic transfers and round-up choices. This guarantees that customers make steady progress toward their savings objectives.

- To help consumers make the most of their savings practices, Bright Money provides specific guidance and insights.

- Bright Money finds chances for saving and offers viable strategies to optimize savings potential by examining users’ purchasing habits and financial objectives.

- Bright Money provides users with the resources and direction required to establish a solid financial foundation, whether it be through budget creation, goal-setting, or progress monitoring.

For those trying to increase their savings and safeguard their financial future, Bright Money is a useful ally. Bright Money enables users to take charge of their finances and confidently reach their savings goals with its innovative functions and individualized approach.

Bright Money Customer Service Review

Bright Money takes great satisfaction in giving its customers outstanding customer service, quickly and effectively resolving any questions or issues. The customer support staff Is bright money legit in 2024has continuously received high marks from users for their professionalism, rapidity, and excitement to help with a range of financial issues.

- Easy access to Bright Money’s customer service is one of its best qualities. The support staff is easily accessible to users via a variety of channels, such as phone, email, and live chat.

- Bright Money’s informed and friendly customer support agents are always ready to help, users have inquiries about how to utilize the platform, require support with problems pertaining to their accounts, or want customized financial guidance.

- Customers value Bright Money’s focus to providing fast, helpful assistance and attending to their needs. To make sure that users’ needs are satisfied and that they like using the platform, the customer support team goes above and beyond.

- Bright Money’s excellent customer service helps to build its reputation as a reliable and easy-to-use financial management tool, garnering attention and appreciation from happy customers.

Bright VS Tally

Popular financial management apps Bright and Tally include a number of tools and features to help users in properly manage their cash. Although the two systems aim to improve financial health, they differ significantly in a few important ways.

| Aspect | Bright | Tally |

|---|---|---|

| Approach | Proactive financial planning and goal setting | Automated debt management and interest savings |

| Pricing Model | Subscription-based | Performance-based |

| Target Audience | Individuals seeking comprehensive financial management | Users focused on debt management |

| User Experience | User-friendly interface and personalized guidance | Automated tools and strategies |

- The ways that Bright and Tally handle budgeting and cost monitoring are one obvious difference. With a focus on proactive financial planning and goal-setting, Bright offers users customized information and suggestions to help them optimize their spending patterns and reach their financial objectives.

- Tally, on the other hand, places a higher priority on automated debt management, assisting customers in reducing their credit card debt and saving interest.

- The pricing models that Tally and Bright employ also set them apart. While Bright charges a monthly or annual subscription fee that gives users access to all features and tools on the platform, Tally charges a fee based on performance, meaning that users only pay a fee if Tally is able to save them money on interest through debt optimization.

Targeting individuals seeking comprehensive financial management solutions, Bright offers a user-friendly interface and personalized guidance to help users improve their overall financial health. Tally, on the other hand, targets users specifically focused on debt management, and provides automated tools and strategies to help users.

FAQs

What is the Bright Money Cost?

- Bright Money charges a monthly or annual subscription fee and operates on this basis.

Can I trust Bright?

- Yes, Bright Money has an excellent track record for offering consistent customer support and efficient financial management solutions, and it is often regarded as trustworthy.

Should I use Bright Money?

- Using Bright Money depends on your individual financial needs and preferences.

Conclusion

In conclusion, Is bright money legit in 2024 is a respectable and real financial management platform that provides users with modern tools and customized insights to maximize their financial well-being.

- Bright Money has gained the trust of its consumers via its dedication to security, transparency, and customer satisfaction.

- It is still a dependable partner in helping people reach their financial objectives.

- Is bright money legit in 2024 gives people the courage to take charge of their finances and create a better financial future by means of its simple layout and proactive approach to financial wellness.

Related Articles

- How does fliff make money in 2024

- 5 secret websites to make money in 2024

- how to make money on tinder in 2024

- Jobs That Pay Weekly 5,000$ – 10,000$